Table of Contents

Are you worried that you’re missing out on money at tax time? Every year, Ontario residents lose hundreds, even thousands of dollars at the table due to a lack of understanding about the personal tax deductions and tax credits available in Ontario. It’s frustrating and confusing, particularly when you want to reduce taxable income yet have no clue where to start.

But here’s the good news: you don’t need to be a tax expert to retain more of what you’ve earned.

In this blog, we’ll walk you through simple and effective ways to minimize your tax bill legally. You’ll learn how to claim deductions, understand key credits, and reveal hidden savings. Let’s make tax time less stressful!

Understanding Tax Deductions and Tax Credits

When you sit down to do your taxes, two key factors can help reduce your bill: tax credits and tax deductions. They sound like they could be the same thing, but they are not.

Tax deductions lower the amount of money the government counts as income. Another way to say it is, they lower your taxable income. If you made $50,000 and took a deduction of $5,000, you would only pay taxes on $45,000. The lower your taxable income is, the less you pay.

Tax credits, on the other hand, deduct cash directly from your taxes. So if you have to pay $2,000 in taxes and you have $500 of tax credits Ontario recognizes, you pay just $1,500. There are two types:

- Non-refundable credits can reduce your tax to zero.

- Refundable credits can send money back to you even if you have to pay zero dollars in taxes.

Both personal tax deductions and tax credits save you money. Knowing how they work will help you make smart choices come tax time.

Most people do not take advantage of these savings because they are unaware of the benefits or their eligibility. In this blog, we will be discussing some of the most common deductions and credits available in Ontario so you can claim more and pay less.

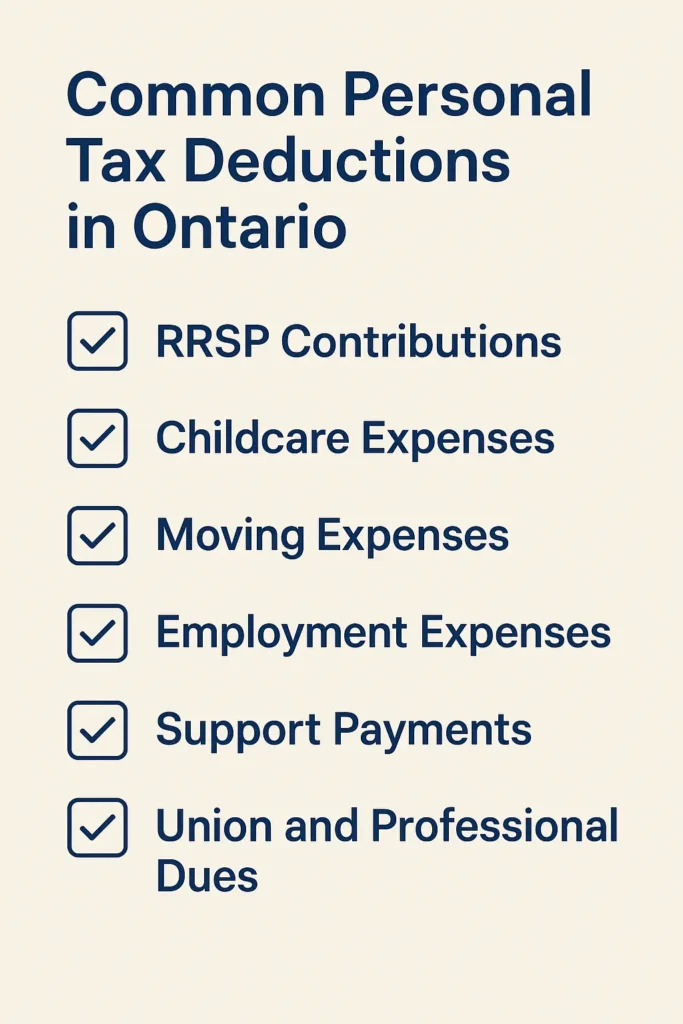

Common Personal Tax Deductions in Ontario

Let’s talk about real strategies that you can use to reduce taxable income with common personal tax deductions found in Ontario. These are not sneaky tactics—just common things that you might already be doing that can save you money at tax time.

1. RRSP Contributions

When you contribute to a Registered Retirement Savings Plan (RRSP), you’re giving your future self a gift and being rewarded right away. The funds you contribute are taken out of your income, so you pay less tax upfront. Let’s say you make $60,000 and contribute $5,000 to your RRSP. You’re only taxed on $55,000. And your savings grow tax-free until retirement. It’s a two-way win.

2. Childcare Expenses

If you pay another person for babysitting, day care, or after-school care so that you can work or go to school, you can also deduct those childcare costs. The deductions help families who are working hard to juggle work and family. All you need to do is save your receipts. And remember, usually the lower-income spouse will have to claim them.

3. Moving Expenses

Did you move at least 40 km to a new place of work or school during the past year? You might be able to claim expenses like gas, truck rental, food, and even overnight stays. Moving isn’t cheap, but the CRA helps to make it affordable if your move qualifies.

4. Employment Expenses

If you have to pay for some equipment, supplies, or even the space in your home to work, you can deduct those. For example, if you work from home, part of your internet and power bills might be deductible. Just make sure your employer recognizes the correct forms.

5. Support Payments

If you pay spousal or child support as part of a court order, some of that money may be tax-deductible. Depending on your situation, this deduction can reduce how much you owe in taxes.

6. Union and Professional Dues

Do you pay union dues or membership fees for a professional organization, such as an accountant or engineer? Here is the good news: those are completely deductible. That is to say, you can deduct them from your income when you do your taxes.

Overlooked Deductions You Might Be Missing

Some tax deductions are commonly missed by many, but they can save you a lot of money. Some of the most missed deductions in Ontario include:

1. Carrying Charges

If you have investments, for instance, mutual funds or stocks, you can deduct the cost of managing them, i.e., investment management fees or fees paid to an investment advisor. This lowers the amount of money the government will count as your income, and you’ll pay less tax.

2. Interest on Student Loans

If you are still paying your student loans, the interest you paid is tax-deductible. You can deduct it each year until the loan is settled. This deduction will reduce the amount of tax you need to pay, giving you a break after all those years of studying.

3. Adoption Expenses

Child adoption can be expensive, but you can claim certain adoption expenses, like legal fees, travel costs, and more. This takes some of the financial stress out of adding to your family.

4. Northern Resident Deductions

If you live in a northern Ontario area, you may qualify for Northern Resident Deductions. These provide extra deductions for living in remote areas with a more expensive cost of living, such as travel and housing costs.

5. Disability Support Deductions

If you are disabled or look after a person who is disabled, you might be able to claim for the cost of supports that you need to work, study, or live. They could be mobility aids or particular equipment.

Don’t let these deductions slip by! They could save you a lot more than you think. Still confused? Get professional help with your personal taxes in Brampton.

Tax-Saving Strategies for Specific Groups

There are various methods that different individuals use to save on taxes. Whether one is self-employed, retired, or a student, there are individual tax deductions and tax credits Ontario provides specifically for each.

1. Self-Employed Individuals

If you are self-employed or freelance, you can deduct business expenses like office supplies, internet, travel, and even part of your house if you work out of your home. These deductions reduce your taxable income; essentially, you get to keep more of your hard-earned money.

It’s worth accumulating all of your receipts and getting accounting software in line so that you’re ready. You’re ready to file when the time comes, and less apt to overlook deductions.

2. Seniors and Retirees

If retired, you have some great options to minimize taxes:

- Pension income splitting allows you to divide income with your spouse, both of you paying lower tax.

- You may deduct medical expenses if they are greater than a certain amount—keep your receipts for prescriptions or dental care.

- The Age Amount Credit is a lump-sum tax reduction for the over-65 set, and it can also lower taxes.

3. Students

If you are a student, you can take the tuition tax credit. If you do not have a lot of tax to pay, you can pass it on to a parent, grandparent, or spouse. In earlier years, students could also claim education and textbook credits. There may still be some available, depending on the year.

Tailoring your tax planning to your own needs is one of the smartest methods to save. Discover expert personal tax deduction strategies.

Tips to Stay Organized Year-Round

Getting ready for tax season doesn’t have to be stressful if you stay organized throughout the year. It’s like dusting a little each day instead of waiting until there is a giant mess. Here are some tips so that you can remain organized:

1. Use a Digital or Physical Filing System

Select a system that works for you, a computer file folder, or a shoebox with labelled envelopes. Put away anything that might be valuable come tax season: receipts, forms, pay stubs, and donation receipts. Having everything together in one place means you won’t be scrambling around looking for things when it’s tax time.

2. Track Expenses Monthly

Don’t wait until the end of the year and attempt to get it all sorted. Spend 10–15 minutes each month going over your expenses. Write it down in a notebook, use an app, or a spreadsheet. Periodic check-ins keep you on top of possible personal tax deductions and make tax time so much simpler.

3. Save Receipts and Categorize Them

Anytime you spend money that could be tax-deductible, such as work supplies, medical expenses, or child care, keep the receipt. Create small categories such as “Work,” “Kids,” “Health,” or “Donations.” This is so you and your accountant know what you can claim.

4. Work With a Professional Accountant

A good accountant will not only help you properly file but also make sure you’re not missing out on any of the tax credits Ontario offers. They can tell you what to account for, what to claim, and how to legally and smartly reduce your taxable income.

Final Thoughts

In the end, taxes aren’t about figures; they’re about your money story. By understanding what deductions and credits can do, you’re not only saving yourself some money, you’re also in control. Whether it’s claiming your RRSP contributions as a write-off, claiming business expenses, or using education credits, it all counts. The more you know and the more organized you are, the less stressful tax time is.

The truth is, you don’t need to be an expert on taxes in one night. Start by getting it all together, asking questions as you go along, and using professional expertise when needed. Simple habits like tracking expenses monthly and retaining receipts can be very helpful. And if in doubt, a clever accountant will make sure that you’re not leaving it all behind. Your future self will thank you for making the effort today to do it properly.